Considering carbon offsetting as the very last option

“Invest in real reductions in emissions, not offsets.”

In this series of blogs, we talk to our specialists at 2BHonest about interesting topics we encounter in our everyday role as sustainability consultants. In this article, Maarten Andriessen shares his insights on CO₂ compensation, also known as ‘carbon offsetting‘. A method whereby a company offsets its carbon emissions by investing in projects that either reduce or absorb carbon emissions. A great story on paper — but in practice there are a lot of pitfalls and obstacles that make it a concept that is not without its controversies. Maarten tells us why and offers better solutions.

Maarten, when I say ‘carbon offsetting’, you say…

Then I say: reduce emissions first and consider offsetting as a very last option.

That’s very clear language. Before we get into that…

What is it in a nutshell?

CO₂ compensation, as in carbon offsetting, means that companies seek to neutralise theircarbon emissions by investing in projects that reduce or absorb carbon dioxide. Think about planting trees, solar and wind energy projects, or energy-efficient technologies such as electric stoves in the developing world. Companies buy so-called credits that are worth a certain amount of offset carbon emissions. The aim is to ‘reduce’ their own emissions, to reach zero or even be ‘climate-positive’ by offsetting more than they emit.

That sounds like a good thing. So why do you say it should be the last option then?

The term ‘climate-neutral’ can become a matter of accounting with ‘pluses and minuses’ using carbon offsets rather than real reductions in emissions. With a bit of creativity, companies can pretty much label themselves ‘zero’ without seriously tackling their own emissions. In essence, the system allows companies to simply buy their way out of dealing with their pollution. And unfortunately, it happens all too often. Some companies paymillions to offset their emissions. This gives them an undeserved green image without helping to solve the climate crisis — although fortunately we are increasingly seeing through this . The money companies spend on offsetting could be invested much more effectively in improving processes to reduce their own carbon footprint.

“The term ‘climate-neutral’ can become a matter of accounting with ‘pluses and minuses’ using carbon offsets rather than real reductions in emissions.”

In addition, you often hear critique about how effective these offsets really are. Can you talk a bit more about that?

Sure, there are plenty of concerns about the effectiveness of carbon offsetting. A major critique is the lack of transparency and guarantees about the actual impact of carbon offsetting projects. It is often difficult to verify that promised carbon reductions are actually achieved, especially as intermediaries often work with small, local organisations. In addition, there is a lack of strict regulation when it comes to certification, which leads to differences in interpretation. There are many different parties offering offsets, each with their own certifications, which makes market forces and credit trading even more complex and less clear-cut. There are also a lot of doubts about the sustainability of these offsets. For example, whether the trees planted will survive in a changing climate, and whether the forests being protected were already under protection or were actually slated for logging.

Because of these substantial doubts and uncertainties, we recommend that this approach be used with great caution. Consider it as a very last option; a ‘last resort.’

What do you actually mean by ‘last resort’?

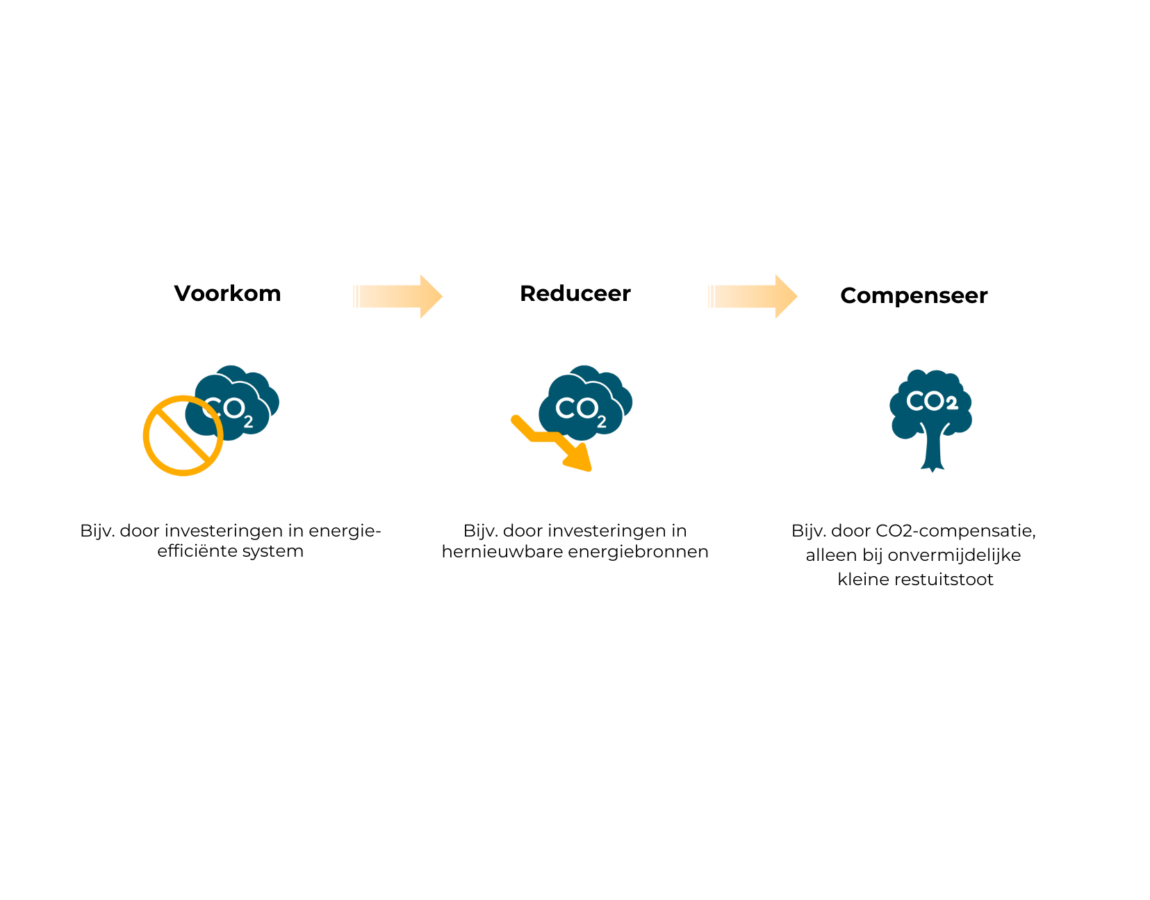

By ‘last resort’ we mean that companies should only consider offsetting after they have made every effort to reduce their own emissions. And then seriously everything. Our approach comprises three steps.

- The first step is to prevent emissions by switching to renewable energy sources and eliminating unnecessary emissions.

- The second step is to reduce the rest of your emissions, for example by increasing energy efficiency and changing your travel behaviour, such as flying less.

- When these steps have been completed – and fully utilised – and a small amount of unavoidable residual emissions remain, then offsetting can be considered. And only through trustworthy and transparent projects.

While we’re on the subject, doesn’t it make much more business sense to ‘prevent and reduce’ than to ‘buy your way out’?

Absolutely. You can only spend your money once. Why go for buying carbon credits — a recurring scheme that you are stuck with every year — when you can invest in your own business? That’s a no-brainer for us. By investing in energy-saving measures and innovative technologies, you can reduce your carbon footprint while lowering your operating costs. Long-term thinking is essential in this regard. Companies will see that buying carbon credits becomes more and more expensive over time, while investing in sustainable solutions is cost-effective. This is not only better for the environment, but also enhances the reputation and long-term vision of your company. In other words, use your resources to actually take action and reduce your emissions yourself. Opt to take action instead of buying it off. The world has much more to gain from that. And so will ultimately your business too.

“Buying carbon credits is a recurring cost and becomes more and more expensive in the long run, whereas investing in sustainable solutions is cost effective.”

How do regulations encourage reducing emissions in-house as opposed to offsetting?

The Paris Climate Agreement requires companies to achieve net zero emissions by 2050. At first glance, offsetting may seem like a satisfactory solution to achieving this target, but the advent of the CSRD makes it clear that ‘creative accounting’ is no longer desirable. After all, the CSRD requires companies to report their carbon emissions, reduction measures and any offsets transparently, which diminishes the value of offsetting as a key strategy for lowering carbon emissions. There is also the Science Based Targets Initiative (SBTi) – which we wrote about earlier — which encourages companies to reduce 90% of their emissions by 2050 and offset only 10%. This emphasises the importance of real emissions reductions over offsets, which will help companies comply with future regulations and contribute to a sustainable economy.

So how can you best offset the last few percent of your carbon emissions, despite the well-known doubts?

First of all, make sure you have done ALL you can to reduce your emissions. Do you follow all the guidelines and is that last 5-10% unavoidable? Then you can opt for offsetting – to deal with those last percentages. Look for an established and reliable offset partner with solid offset projects that you can trust as a business. Know that there is never a 100% guarantee that these projects will deliver all the carbon reductions they promise. But if you are confident that you have done all you can to minimise your own emissions, you can communicate this to your stakeholders and customers in a responsible way

For us, it remains a straightforward matter: do you have any budget to spare? Always invest in prevention and reduction. Trust me, there is always a way to create even more impact with the resources you have.

In conclusion

Companies ought to focus on actively preventing and reducing their carbon emissions, rather than opting for carbon offsetting. This is not only better for the environment, but also enhances the reputation and long-term vision of companies. Offsetting emissions should only be considered after all other options have been utilised.

Want to know more about preventing, reducing and offsetting emissions? Maarten is on hand to help!

Maarten Andriessen

Passionate about helping clients turn their sustainable ambitions into successes.

Link with Maarten